Which Payment Method Should You Choose for Dropshipping? Complete Guide

Dropshipping Fees

Author:

January 24, 2026

Contents

To learn how to pay for dropshipping, you need a payment method that is secure, fast, and accepted by your supplier. Without a reliable payment setup, your business can quickly slow down or break.

In dropshipping, you sell products without holding inventory. Your supplier ships directly to your customers, and in most cases, nothing is fulfilled until the payment is confirmed. On top of that, you must anticipate dropshipping fees such as transaction fees, platform fees, and processing costs. Credit cards, PayPal, Stripe, and bank transfers all have their advantages, but which option is best to manage supplier payments smoothly? Let’s break down how to pay for dropshipping orders safely and efficiently.

Why Supplier Payments Matter in Dropshipping

To succeed in dropshipping, selling is only part of the equation. You also need to master logistics, especially payments. Supplier payments directly impact shipping speed, service reliability, and long-term customer satisfaction.

Paying your supplier confirms the order. Once payment is processed, the supplier starts fulfillment and shipping. A reliable payment system helps you:

reassure suppliers that you are a serious business partner,

build long-term relationships,

negotiate better terms such as discounts or delayed payments.

On the other hand, late or inconsistent payments can cause fulfillment delays, disputes, or even a breakdown in collaboration, putting your entire business at risk. That’s why choosing the right payment method is essential when deciding how to pay for dropshipping products. Suppliers have different preferences: some favor PayPal, others prefer Stripe or bank transfers. Payment gateways help streamline these transactions and keep operations running smoothly.

To learn how to pay for dropshipping, you need a payment method that is secure, fast, and accepted by your supplier. Without a reliable payment setup, your business can quickly slow down or break.

In dropshipping, you sell products without holding inventory. Your supplier ships directly to your customers, and in most cases, nothing is fulfilled until the payment is confirmed. On top of that, you must anticipate dropshipping fees such as transaction fees, platform fees, and processing costs. Credit cards, PayPal, Stripe, and bank transfers all have their advantages, but which option is best to manage supplier payments smoothly? Let’s break down how to pay for dropshipping orders safely and efficiently.

Why Supplier Payments Matter in Dropshipping

To succeed in dropshipping, selling is only part of the equation. You also need to master logistics, especially payments. Supplier payments directly impact shipping speed, service reliability, and long-term customer satisfaction.

Paying your supplier confirms the order. Once payment is processed, the supplier starts fulfillment and shipping. A reliable payment system helps you:

reassure suppliers that you are a serious business partner,

build long-term relationships,

negotiate better terms such as discounts or delayed payments.

On the other hand, late or inconsistent payments can cause fulfillment delays, disputes, or even a breakdown in collaboration, putting your entire business at risk. That’s why choosing the right payment method is essential when deciding how to pay for dropshipping products. Suppliers have different preferences: some favor PayPal, others prefer Stripe or bank transfers. Payment gateways help streamline these transactions and keep operations running smoothly.

To learn how to pay for dropshipping, you need a payment method that is secure, fast, and accepted by your supplier. Without a reliable payment setup, your business can quickly slow down or break.

In dropshipping, you sell products without holding inventory. Your supplier ships directly to your customers, and in most cases, nothing is fulfilled until the payment is confirmed. On top of that, you must anticipate dropshipping fees such as transaction fees, platform fees, and processing costs. Credit cards, PayPal, Stripe, and bank transfers all have their advantages, but which option is best to manage supplier payments smoothly? Let’s break down how to pay for dropshipping orders safely and efficiently.

Why Supplier Payments Matter in Dropshipping

To succeed in dropshipping, selling is only part of the equation. You also need to master logistics, especially payments. Supplier payments directly impact shipping speed, service reliability, and long-term customer satisfaction.

Paying your supplier confirms the order. Once payment is processed, the supplier starts fulfillment and shipping. A reliable payment system helps you:

reassure suppliers that you are a serious business partner,

build long-term relationships,

negotiate better terms such as discounts or delayed payments.

On the other hand, late or inconsistent payments can cause fulfillment delays, disputes, or even a breakdown in collaboration, putting your entire business at risk. That’s why choosing the right payment method is essential when deciding how to pay for dropshipping products. Suppliers have different preferences: some favor PayPal, others prefer Stripe or bank transfers. Payment gateways help streamline these transactions and keep operations running smoothly.

To learn how to pay for dropshipping, you need a payment method that is secure, fast, and accepted by your supplier. Without a reliable payment setup, your business can quickly slow down or break.

In dropshipping, you sell products without holding inventory. Your supplier ships directly to your customers, and in most cases, nothing is fulfilled until the payment is confirmed. On top of that, you must anticipate dropshipping fees such as transaction fees, platform fees, and processing costs. Credit cards, PayPal, Stripe, and bank transfers all have their advantages, but which option is best to manage supplier payments smoothly? Let’s break down how to pay for dropshipping orders safely and efficiently.

Why Supplier Payments Matter in Dropshipping

To succeed in dropshipping, selling is only part of the equation. You also need to master logistics, especially payments. Supplier payments directly impact shipping speed, service reliability, and long-term customer satisfaction.

Paying your supplier confirms the order. Once payment is processed, the supplier starts fulfillment and shipping. A reliable payment system helps you:

reassure suppliers that you are a serious business partner,

build long-term relationships,

negotiate better terms such as discounts or delayed payments.

On the other hand, late or inconsistent payments can cause fulfillment delays, disputes, or even a breakdown in collaboration, putting your entire business at risk. That’s why choosing the right payment method is essential when deciding how to pay for dropshipping products. Suppliers have different preferences: some favor PayPal, others prefer Stripe or bank transfers. Payment gateways help streamline these transactions and keep operations running smoothly.

To learn how to pay for dropshipping, you need a payment method that is secure, fast, and accepted by your supplier. Without a reliable payment setup, your business can quickly slow down or break.

In dropshipping, you sell products without holding inventory. Your supplier ships directly to your customers, and in most cases, nothing is fulfilled until the payment is confirmed. On top of that, you must anticipate dropshipping fees such as transaction fees, platform fees, and processing costs. Credit cards, PayPal, Stripe, and bank transfers all have their advantages, but which option is best to manage supplier payments smoothly? Let’s break down how to pay for dropshipping orders safely and efficiently.

Why Supplier Payments Matter in Dropshipping

To succeed in dropshipping, selling is only part of the equation. You also need to master logistics, especially payments. Supplier payments directly impact shipping speed, service reliability, and long-term customer satisfaction.

Paying your supplier confirms the order. Once payment is processed, the supplier starts fulfillment and shipping. A reliable payment system helps you:

reassure suppliers that you are a serious business partner,

build long-term relationships,

negotiate better terms such as discounts or delayed payments.

On the other hand, late or inconsistent payments can cause fulfillment delays, disputes, or even a breakdown in collaboration, putting your entire business at risk. That’s why choosing the right payment method is essential when deciding how to pay for dropshipping products. Suppliers have different preferences: some favor PayPal, others prefer Stripe or bank transfers. Payment gateways help streamline these transactions and keep operations running smoothly.

To learn how to pay for dropshipping, you need a payment method that is secure, fast, and accepted by your supplier. Without a reliable payment setup, your business can quickly slow down or break.

In dropshipping, you sell products without holding inventory. Your supplier ships directly to your customers, and in most cases, nothing is fulfilled until the payment is confirmed. On top of that, you must anticipate dropshipping fees such as transaction fees, platform fees, and processing costs. Credit cards, PayPal, Stripe, and bank transfers all have their advantages, but which option is best to manage supplier payments smoothly? Let’s break down how to pay for dropshipping orders safely and efficiently.

Why Supplier Payments Matter in Dropshipping

To succeed in dropshipping, selling is only part of the equation. You also need to master logistics, especially payments. Supplier payments directly impact shipping speed, service reliability, and long-term customer satisfaction.

Paying your supplier confirms the order. Once payment is processed, the supplier starts fulfillment and shipping. A reliable payment system helps you:

reassure suppliers that you are a serious business partner,

build long-term relationships,

negotiate better terms such as discounts or delayed payments.

On the other hand, late or inconsistent payments can cause fulfillment delays, disputes, or even a breakdown in collaboration, putting your entire business at risk. That’s why choosing the right payment method is essential when deciding how to pay for dropshipping products. Suppliers have different preferences: some favor PayPal, others prefer Stripe or bank transfers. Payment gateways help streamline these transactions and keep operations running smoothly.

Minea

Reach $1,000 per day or get your money back

Minea

Reach $1,000 per day or get your money back

Minea

Reach $1,000 per day or get your money back

Minea

Reach $1,000 per day or get your money back

Minea

Reach $1,000 per day or get your money back

Minea

Reach $1,000 per day or get your money back

Credit Cards and Debit Cards

Many dropshippers rely on debit or credit cards to pay suppliers because they are convenient, fast, and widely accepted. Most suppliers, whether on AliExpress, through private agents, or on specialized platforms, accept major cards and modern solutions like Wise or Revolut. Cards are often the simplest answer to how to pay for the customer's product on dropshipping without adding unnecessary complexity.

Visa

Visa is one of the most widely accepted payment networks worldwide. It allows you to pay suppliers quickly, especially on platforms like AliExpress or CJdropshipping. Payments are secure, traceable, and compatible with most gateways, including PayPal and Stripe. This makes Visa ideal for beginners learning how to pay for your aliexpress dropshipping without friction.

Mastercard

Mastercard is a direct alternative to Visa, offering the same benefits in terms of security, speed, and global acceptance. Many international suppliers accept Mastercard, and some premium cards include cashback programs or insurance coverage, useful in case of disputes or non-delivery.

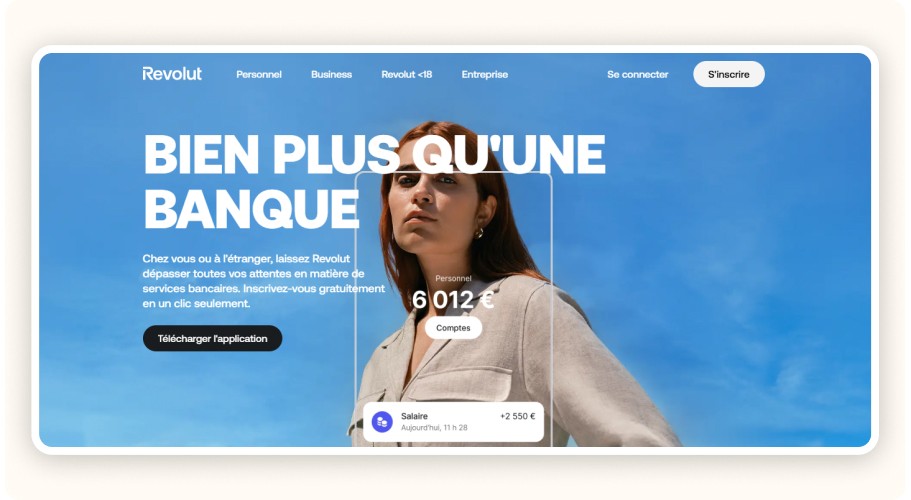

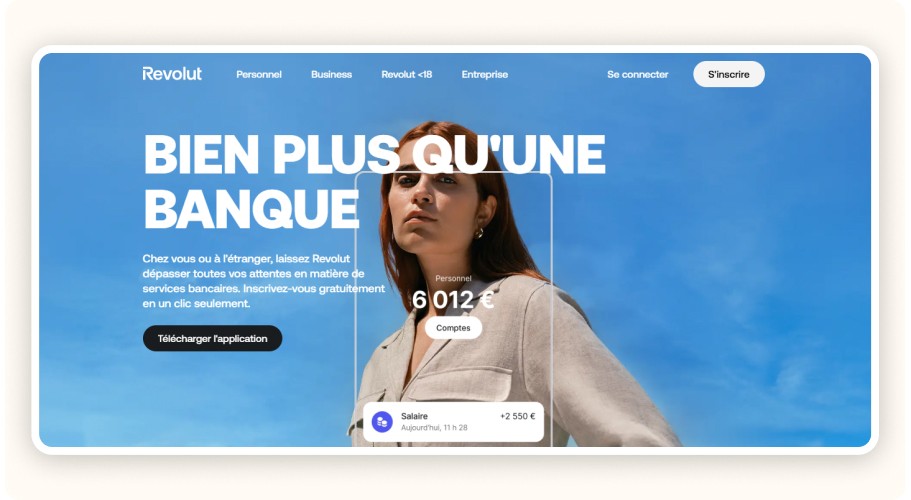

Revolut

Revolut is a modern neobank that lets you create virtual cards, manage multiple currencies, and track expenses by category. In dropshipping, Revolut Business helps automate supplier payments and clearly segment costs. Thanks to competitive exchange rates, it’s a smart option when learning how to pay for dropshipping orders while protecting margins and simplifying operations.

Wise

Wise is ideal for international payments. It allows you to pay in 50+ currencies at the real market rate, with no hidden fees. This makes Wise perfect for working with Asian or European suppliers and staying in control of cash flow, especially when figuring out how to pay for dropshipping products across borders.

Benefits of Paying Suppliers by Debit or Credit Card

Using cards remains one of the easiest ways to understand how to pay for the customers product on dropshipping. Key advantages include:

instant transactions,

easy traceability to prevent disputes,

no extra fees, especially with neobanks like Revolut,

cashback programs or purchase protection with some cards.

That said, each card has its own rules. Always check:

daily or monthly payment limits to avoid blocks,

foreign currency support (USD, CNY, etc.) for international suppliers.

For a secure setup at scale, virtual cards (such as those from Wise or Revolut Business) are highly recommended, especially during high-volume processing.

Credit Cards and Debit Cards

Many dropshippers rely on debit or credit cards to pay suppliers because they are convenient, fast, and widely accepted. Most suppliers, whether on AliExpress, through private agents, or on specialized platforms, accept major cards and modern solutions like Wise or Revolut. Cards are often the simplest answer to how to pay for the customer's product on dropshipping without adding unnecessary complexity.

Visa

Visa is one of the most widely accepted payment networks worldwide. It allows you to pay suppliers quickly, especially on platforms like AliExpress or CJdropshipping. Payments are secure, traceable, and compatible with most gateways, including PayPal and Stripe. This makes Visa ideal for beginners learning how to pay for your aliexpress dropshipping without friction.

Mastercard

Mastercard is a direct alternative to Visa, offering the same benefits in terms of security, speed, and global acceptance. Many international suppliers accept Mastercard, and some premium cards include cashback programs or insurance coverage, useful in case of disputes or non-delivery.

Revolut

Revolut is a modern neobank that lets you create virtual cards, manage multiple currencies, and track expenses by category. In dropshipping, Revolut Business helps automate supplier payments and clearly segment costs. Thanks to competitive exchange rates, it’s a smart option when learning how to pay for dropshipping orders while protecting margins and simplifying operations.

Wise

Wise is ideal for international payments. It allows you to pay in 50+ currencies at the real market rate, with no hidden fees. This makes Wise perfect for working with Asian or European suppliers and staying in control of cash flow, especially when figuring out how to pay for dropshipping products across borders.

Benefits of Paying Suppliers by Debit or Credit Card

Using cards remains one of the easiest ways to understand how to pay for the customers product on dropshipping. Key advantages include:

instant transactions,

easy traceability to prevent disputes,

no extra fees, especially with neobanks like Revolut,

cashback programs or purchase protection with some cards.

That said, each card has its own rules. Always check:

daily or monthly payment limits to avoid blocks,

foreign currency support (USD, CNY, etc.) for international suppliers.

For a secure setup at scale, virtual cards (such as those from Wise or Revolut Business) are highly recommended, especially during high-volume processing.

Credit Cards and Debit Cards

Many dropshippers rely on debit or credit cards to pay suppliers because they are convenient, fast, and widely accepted. Most suppliers, whether on AliExpress, through private agents, or on specialized platforms, accept major cards and modern solutions like Wise or Revolut. Cards are often the simplest answer to how to pay for the customer's product on dropshipping without adding unnecessary complexity.

Visa

Visa is one of the most widely accepted payment networks worldwide. It allows you to pay suppliers quickly, especially on platforms like AliExpress or CJdropshipping. Payments are secure, traceable, and compatible with most gateways, including PayPal and Stripe. This makes Visa ideal for beginners learning how to pay for your aliexpress dropshipping without friction.

Mastercard

Mastercard is a direct alternative to Visa, offering the same benefits in terms of security, speed, and global acceptance. Many international suppliers accept Mastercard, and some premium cards include cashback programs or insurance coverage, useful in case of disputes or non-delivery.

Revolut

Revolut is a modern neobank that lets you create virtual cards, manage multiple currencies, and track expenses by category. In dropshipping, Revolut Business helps automate supplier payments and clearly segment costs. Thanks to competitive exchange rates, it’s a smart option when learning how to pay for dropshipping orders while protecting margins and simplifying operations.

Wise

Wise is ideal for international payments. It allows you to pay in 50+ currencies at the real market rate, with no hidden fees. This makes Wise perfect for working with Asian or European suppliers and staying in control of cash flow, especially when figuring out how to pay for dropshipping products across borders.

Benefits of Paying Suppliers by Debit or Credit Card

Using cards remains one of the easiest ways to understand how to pay for the customers product on dropshipping. Key advantages include:

instant transactions,

easy traceability to prevent disputes,

no extra fees, especially with neobanks like Revolut,

cashback programs or purchase protection with some cards.

That said, each card has its own rules. Always check:

daily or monthly payment limits to avoid blocks,

foreign currency support (USD, CNY, etc.) for international suppliers.

For a secure setup at scale, virtual cards (such as those from Wise or Revolut Business) are highly recommended, especially during high-volume processing.

Credit Cards and Debit Cards

Many dropshippers rely on debit or credit cards to pay suppliers because they are convenient, fast, and widely accepted. Most suppliers, whether on AliExpress, through private agents, or on specialized platforms, accept major cards and modern solutions like Wise or Revolut. Cards are often the simplest answer to how to pay for the customer's product on dropshipping without adding unnecessary complexity.

Visa

Visa is one of the most widely accepted payment networks worldwide. It allows you to pay suppliers quickly, especially on platforms like AliExpress or CJdropshipping. Payments are secure, traceable, and compatible with most gateways, including PayPal and Stripe. This makes Visa ideal for beginners learning how to pay for your aliexpress dropshipping without friction.

Mastercard

Mastercard is a direct alternative to Visa, offering the same benefits in terms of security, speed, and global acceptance. Many international suppliers accept Mastercard, and some premium cards include cashback programs or insurance coverage, useful in case of disputes or non-delivery.

Revolut

Revolut is a modern neobank that lets you create virtual cards, manage multiple currencies, and track expenses by category. In dropshipping, Revolut Business helps automate supplier payments and clearly segment costs. Thanks to competitive exchange rates, it’s a smart option when learning how to pay for dropshipping orders while protecting margins and simplifying operations.

Wise

Wise is ideal for international payments. It allows you to pay in 50+ currencies at the real market rate, with no hidden fees. This makes Wise perfect for working with Asian or European suppliers and staying in control of cash flow, especially when figuring out how to pay for dropshipping products across borders.

Benefits of Paying Suppliers by Debit or Credit Card

Using cards remains one of the easiest ways to understand how to pay for the customers product on dropshipping. Key advantages include:

instant transactions,

easy traceability to prevent disputes,

no extra fees, especially with neobanks like Revolut,

cashback programs or purchase protection with some cards.

That said, each card has its own rules. Always check:

daily or monthly payment limits to avoid blocks,

foreign currency support (USD, CNY, etc.) for international suppliers.

For a secure setup at scale, virtual cards (such as those from Wise or Revolut Business) are highly recommended, especially during high-volume processing.

Credit Cards and Debit Cards

Many dropshippers rely on debit or credit cards to pay suppliers because they are convenient, fast, and widely accepted. Most suppliers, whether on AliExpress, through private agents, or on specialized platforms, accept major cards and modern solutions like Wise or Revolut. Cards are often the simplest answer to how to pay for the customer's product on dropshipping without adding unnecessary complexity.

Visa

Visa is one of the most widely accepted payment networks worldwide. It allows you to pay suppliers quickly, especially on platforms like AliExpress or CJdropshipping. Payments are secure, traceable, and compatible with most gateways, including PayPal and Stripe. This makes Visa ideal for beginners learning how to pay for your aliexpress dropshipping without friction.

Mastercard

Mastercard is a direct alternative to Visa, offering the same benefits in terms of security, speed, and global acceptance. Many international suppliers accept Mastercard, and some premium cards include cashback programs or insurance coverage, useful in case of disputes or non-delivery.

Revolut

Revolut is a modern neobank that lets you create virtual cards, manage multiple currencies, and track expenses by category. In dropshipping, Revolut Business helps automate supplier payments and clearly segment costs. Thanks to competitive exchange rates, it’s a smart option when learning how to pay for dropshipping orders while protecting margins and simplifying operations.

Wise

Wise is ideal for international payments. It allows you to pay in 50+ currencies at the real market rate, with no hidden fees. This makes Wise perfect for working with Asian or European suppliers and staying in control of cash flow, especially when figuring out how to pay for dropshipping products across borders.

Benefits of Paying Suppliers by Debit or Credit Card

Using cards remains one of the easiest ways to understand how to pay for the customers product on dropshipping. Key advantages include:

instant transactions,

easy traceability to prevent disputes,

no extra fees, especially with neobanks like Revolut,

cashback programs or purchase protection with some cards.

That said, each card has its own rules. Always check:

daily or monthly payment limits to avoid blocks,

foreign currency support (USD, CNY, etc.) for international suppliers.

For a secure setup at scale, virtual cards (such as those from Wise or Revolut Business) are highly recommended, especially during high-volume processing.

Credit Cards and Debit Cards

Many dropshippers rely on debit or credit cards to pay suppliers because they are convenient, fast, and widely accepted. Most suppliers, whether on AliExpress, through private agents, or on specialized platforms, accept major cards and modern solutions like Wise or Revolut. Cards are often the simplest answer to how to pay for the customer's product on dropshipping without adding unnecessary complexity.

Visa

Visa is one of the most widely accepted payment networks worldwide. It allows you to pay suppliers quickly, especially on platforms like AliExpress or CJdropshipping. Payments are secure, traceable, and compatible with most gateways, including PayPal and Stripe. This makes Visa ideal for beginners learning how to pay for your aliexpress dropshipping without friction.

Mastercard

Mastercard is a direct alternative to Visa, offering the same benefits in terms of security, speed, and global acceptance. Many international suppliers accept Mastercard, and some premium cards include cashback programs or insurance coverage, useful in case of disputes or non-delivery.

Revolut

Revolut is a modern neobank that lets you create virtual cards, manage multiple currencies, and track expenses by category. In dropshipping, Revolut Business helps automate supplier payments and clearly segment costs. Thanks to competitive exchange rates, it’s a smart option when learning how to pay for dropshipping orders while protecting margins and simplifying operations.

Wise

Wise is ideal for international payments. It allows you to pay in 50+ currencies at the real market rate, with no hidden fees. This makes Wise perfect for working with Asian or European suppliers and staying in control of cash flow, especially when figuring out how to pay for dropshipping products across borders.

Benefits of Paying Suppliers by Debit or Credit Card

Using cards remains one of the easiest ways to understand how to pay for the customers product on dropshipping. Key advantages include:

instant transactions,

easy traceability to prevent disputes,

no extra fees, especially with neobanks like Revolut,

cashback programs or purchase protection with some cards.

That said, each card has its own rules. Always check:

daily or monthly payment limits to avoid blocks,

foreign currency support (USD, CNY, etc.) for international suppliers.

For a secure setup at scale, virtual cards (such as those from Wise or Revolut Business) are highly recommended, especially during high-volume processing.

Paying Suppliers by Bank Transfer

B2B suppliers and long-term partners often prefer bank transfers. While setup is more complex, this method suits large volumes and is common with European suppliers. Benefits include:

stronger security through contracts and invoicing,

easy integration with accounting tools.

The downside is processing time, typically 2 to 5 business days, and interbank fees, especially for international transfers. Some Chinese or Turkish suppliers require SWIFT transfers, which can cost $10–$50 per transaction. For established relationships, this method remains reliable when deciding how to pay for dropshipping orders at scale.

Mobile Payments (Apple Pay, Google Pay)

Mobile payments like Apple Pay and Google Pay have grown fast in recent years. They offer:

a smooth user experience,

built-in security via Face ID or fingerprint authentication,

direct compatibility with Stripe and Shopify Payments, making setup easy.

You can also use mobile payments for quick tests or one-off product purchases through mobile apps. However, many suppliers still don’t accept them. Always confirm compatibility before choosing this option, especially when learning how to pay for dropshipping efficiently

How Do Payment Gateways and Payment Processors Work in Dropshipping?

When a customer places an order in your store, it’s not just a simple payment. A series of invisible technical interactions happen behind the scenes. To understand how to pay for dropshipping smoothly, from the customer to the supplier, you need to understand the role of payment gateways and payment processors.

What Is a Payment Gateway?

A payment gateway is a technical intermediary. It securely transmits a customer’s banking information to your payment system. Think of it as a digital bridge between your dropshipping store and the customer’s bank. The gateway does not hold funds; it only ensures secure data transfer.

How it works:

The customer submits payment details,

The gateway encrypts sensitive data,

The information is verified and sent to the payment processor.

This guarantees confidentiality and transaction security.

The most commonly used gateways in dropshipping are:

Stripe – known for its smooth interface and powerful API,

Shopify Payments – built directly into Shopify for easier management,

PayPal – globally recognized and easy to integrate.

What About the Payment Processor?

The payment processor is the service that actually executes the transaction. It communicates with the customer’s bank, checks fund availability, and transfers the money to your merchant account. This happens after the gateway step.

Examples of processors often connected to gateways include First Data, Worldpay, and Adyen. Some solutions, like Stripe and PayPal, act as both gateway and processor.

The key difference:

The gateway transmits information,

The processor validates and moves the funds.

How They Work Together

The full payment flow works as a smooth, automated chain:

The customer enters payment details on your store,

The gateway encrypts and transmits the data,

The processor validates the payment and completes the bank transaction,

Funds arrive in your merchant account or an intermediary balance (e.g., PayPal),

You then use these funds to pay your supplier.

This gateway–processor duo ensures a secure, fast, and dropshipping-friendly payment setup, critical when deciding how to pay for dropshipping orders at scale.

Paying Suppliers by Bank Transfer

B2B suppliers and long-term partners often prefer bank transfers. While setup is more complex, this method suits large volumes and is common with European suppliers. Benefits include:

stronger security through contracts and invoicing,

easy integration with accounting tools.

The downside is processing time, typically 2 to 5 business days, and interbank fees, especially for international transfers. Some Chinese or Turkish suppliers require SWIFT transfers, which can cost $10–$50 per transaction. For established relationships, this method remains reliable when deciding how to pay for dropshipping orders at scale.

Mobile Payments (Apple Pay, Google Pay)

Mobile payments like Apple Pay and Google Pay have grown fast in recent years. They offer:

a smooth user experience,

built-in security via Face ID or fingerprint authentication,

direct compatibility with Stripe and Shopify Payments, making setup easy.

You can also use mobile payments for quick tests or one-off product purchases through mobile apps. However, many suppliers still don’t accept them. Always confirm compatibility before choosing this option, especially when learning how to pay for dropshipping efficiently

How Do Payment Gateways and Payment Processors Work in Dropshipping?

When a customer places an order in your store, it’s not just a simple payment. A series of invisible technical interactions happen behind the scenes. To understand how to pay for dropshipping smoothly, from the customer to the supplier, you need to understand the role of payment gateways and payment processors.

What Is a Payment Gateway?

A payment gateway is a technical intermediary. It securely transmits a customer’s banking information to your payment system. Think of it as a digital bridge between your dropshipping store and the customer’s bank. The gateway does not hold funds; it only ensures secure data transfer.

How it works:

The customer submits payment details,

The gateway encrypts sensitive data,

The information is verified and sent to the payment processor.

This guarantees confidentiality and transaction security.

The most commonly used gateways in dropshipping are:

Stripe – known for its smooth interface and powerful API,

Shopify Payments – built directly into Shopify for easier management,

PayPal – globally recognized and easy to integrate.

What About the Payment Processor?

The payment processor is the service that actually executes the transaction. It communicates with the customer’s bank, checks fund availability, and transfers the money to your merchant account. This happens after the gateway step.

Examples of processors often connected to gateways include First Data, Worldpay, and Adyen. Some solutions, like Stripe and PayPal, act as both gateway and processor.

The key difference:

The gateway transmits information,

The processor validates and moves the funds.

How They Work Together

The full payment flow works as a smooth, automated chain:

The customer enters payment details on your store,

The gateway encrypts and transmits the data,

The processor validates the payment and completes the bank transaction,

Funds arrive in your merchant account or an intermediary balance (e.g., PayPal),

You then use these funds to pay your supplier.

This gateway–processor duo ensures a secure, fast, and dropshipping-friendly payment setup, critical when deciding how to pay for dropshipping orders at scale.

Paying Suppliers by Bank Transfer

B2B suppliers and long-term partners often prefer bank transfers. While setup is more complex, this method suits large volumes and is common with European suppliers. Benefits include:

stronger security through contracts and invoicing,

easy integration with accounting tools.

The downside is processing time, typically 2 to 5 business days, and interbank fees, especially for international transfers. Some Chinese or Turkish suppliers require SWIFT transfers, which can cost $10–$50 per transaction. For established relationships, this method remains reliable when deciding how to pay for dropshipping orders at scale.

Mobile Payments (Apple Pay, Google Pay)

Mobile payments like Apple Pay and Google Pay have grown fast in recent years. They offer:

a smooth user experience,

built-in security via Face ID or fingerprint authentication,

direct compatibility with Stripe and Shopify Payments, making setup easy.

You can also use mobile payments for quick tests or one-off product purchases through mobile apps. However, many suppliers still don’t accept them. Always confirm compatibility before choosing this option, especially when learning how to pay for dropshipping efficiently

How Do Payment Gateways and Payment Processors Work in Dropshipping?

When a customer places an order in your store, it’s not just a simple payment. A series of invisible technical interactions happen behind the scenes. To understand how to pay for dropshipping smoothly, from the customer to the supplier, you need to understand the role of payment gateways and payment processors.

What Is a Payment Gateway?

A payment gateway is a technical intermediary. It securely transmits a customer’s banking information to your payment system. Think of it as a digital bridge between your dropshipping store and the customer’s bank. The gateway does not hold funds; it only ensures secure data transfer.

How it works:

The customer submits payment details,

The gateway encrypts sensitive data,

The information is verified and sent to the payment processor.

This guarantees confidentiality and transaction security.

The most commonly used gateways in dropshipping are:

Stripe – known for its smooth interface and powerful API,

Shopify Payments – built directly into Shopify for easier management,

PayPal – globally recognized and easy to integrate.

What About the Payment Processor?

The payment processor is the service that actually executes the transaction. It communicates with the customer’s bank, checks fund availability, and transfers the money to your merchant account. This happens after the gateway step.

Examples of processors often connected to gateways include First Data, Worldpay, and Adyen. Some solutions, like Stripe and PayPal, act as both gateway and processor.

The key difference:

The gateway transmits information,

The processor validates and moves the funds.

How They Work Together

The full payment flow works as a smooth, automated chain:

The customer enters payment details on your store,

The gateway encrypts and transmits the data,

The processor validates the payment and completes the bank transaction,

Funds arrive in your merchant account or an intermediary balance (e.g., PayPal),

You then use these funds to pay your supplier.

This gateway–processor duo ensures a secure, fast, and dropshipping-friendly payment setup, critical when deciding how to pay for dropshipping orders at scale.

Paying Suppliers by Bank Transfer

B2B suppliers and long-term partners often prefer bank transfers. While setup is more complex, this method suits large volumes and is common with European suppliers. Benefits include:

stronger security through contracts and invoicing,

easy integration with accounting tools.

The downside is processing time, typically 2 to 5 business days, and interbank fees, especially for international transfers. Some Chinese or Turkish suppliers require SWIFT transfers, which can cost $10–$50 per transaction. For established relationships, this method remains reliable when deciding how to pay for dropshipping orders at scale.

Mobile Payments (Apple Pay, Google Pay)

Mobile payments like Apple Pay and Google Pay have grown fast in recent years. They offer:

a smooth user experience,

built-in security via Face ID or fingerprint authentication,

direct compatibility with Stripe and Shopify Payments, making setup easy.

You can also use mobile payments for quick tests or one-off product purchases through mobile apps. However, many suppliers still don’t accept them. Always confirm compatibility before choosing this option, especially when learning how to pay for dropshipping efficiently

How Do Payment Gateways and Payment Processors Work in Dropshipping?

When a customer places an order in your store, it’s not just a simple payment. A series of invisible technical interactions happen behind the scenes. To understand how to pay for dropshipping smoothly, from the customer to the supplier, you need to understand the role of payment gateways and payment processors.

What Is a Payment Gateway?

A payment gateway is a technical intermediary. It securely transmits a customer’s banking information to your payment system. Think of it as a digital bridge between your dropshipping store and the customer’s bank. The gateway does not hold funds; it only ensures secure data transfer.

How it works:

The customer submits payment details,

The gateway encrypts sensitive data,

The information is verified and sent to the payment processor.

This guarantees confidentiality and transaction security.

The most commonly used gateways in dropshipping are:

Stripe – known for its smooth interface and powerful API,

Shopify Payments – built directly into Shopify for easier management,

PayPal – globally recognized and easy to integrate.

What About the Payment Processor?

The payment processor is the service that actually executes the transaction. It communicates with the customer’s bank, checks fund availability, and transfers the money to your merchant account. This happens after the gateway step.

Examples of processors often connected to gateways include First Data, Worldpay, and Adyen. Some solutions, like Stripe and PayPal, act as both gateway and processor.

The key difference:

The gateway transmits information,

The processor validates and moves the funds.

How They Work Together

The full payment flow works as a smooth, automated chain:

The customer enters payment details on your store,

The gateway encrypts and transmits the data,

The processor validates the payment and completes the bank transaction,

Funds arrive in your merchant account or an intermediary balance (e.g., PayPal),

You then use these funds to pay your supplier.

This gateway–processor duo ensures a secure, fast, and dropshipping-friendly payment setup, critical when deciding how to pay for dropshipping orders at scale.

Paying Suppliers by Bank Transfer

B2B suppliers and long-term partners often prefer bank transfers. While setup is more complex, this method suits large volumes and is common with European suppliers. Benefits include:

stronger security through contracts and invoicing,

easy integration with accounting tools.

The downside is processing time, typically 2 to 5 business days, and interbank fees, especially for international transfers. Some Chinese or Turkish suppliers require SWIFT transfers, which can cost $10–$50 per transaction. For established relationships, this method remains reliable when deciding how to pay for dropshipping orders at scale.

Mobile Payments (Apple Pay, Google Pay)

Mobile payments like Apple Pay and Google Pay have grown fast in recent years. They offer:

a smooth user experience,

built-in security via Face ID or fingerprint authentication,

direct compatibility with Stripe and Shopify Payments, making setup easy.

You can also use mobile payments for quick tests or one-off product purchases through mobile apps. However, many suppliers still don’t accept them. Always confirm compatibility before choosing this option, especially when learning how to pay for dropshipping efficiently

How Do Payment Gateways and Payment Processors Work in Dropshipping?

When a customer places an order in your store, it’s not just a simple payment. A series of invisible technical interactions happen behind the scenes. To understand how to pay for dropshipping smoothly, from the customer to the supplier, you need to understand the role of payment gateways and payment processors.

What Is a Payment Gateway?

A payment gateway is a technical intermediary. It securely transmits a customer’s banking information to your payment system. Think of it as a digital bridge between your dropshipping store and the customer’s bank. The gateway does not hold funds; it only ensures secure data transfer.

How it works:

The customer submits payment details,

The gateway encrypts sensitive data,

The information is verified and sent to the payment processor.

This guarantees confidentiality and transaction security.

The most commonly used gateways in dropshipping are:

Stripe – known for its smooth interface and powerful API,

Shopify Payments – built directly into Shopify for easier management,

PayPal – globally recognized and easy to integrate.

What About the Payment Processor?

The payment processor is the service that actually executes the transaction. It communicates with the customer’s bank, checks fund availability, and transfers the money to your merchant account. This happens after the gateway step.

Examples of processors often connected to gateways include First Data, Worldpay, and Adyen. Some solutions, like Stripe and PayPal, act as both gateway and processor.

The key difference:

The gateway transmits information,

The processor validates and moves the funds.

How They Work Together

The full payment flow works as a smooth, automated chain:

The customer enters payment details on your store,

The gateway encrypts and transmits the data,

The processor validates the payment and completes the bank transaction,

Funds arrive in your merchant account or an intermediary balance (e.g., PayPal),

You then use these funds to pay your supplier.

This gateway–processor duo ensures a secure, fast, and dropshipping-friendly payment setup, critical when deciding how to pay for dropshipping orders at scale.

Paying Suppliers by Bank Transfer

B2B suppliers and long-term partners often prefer bank transfers. While setup is more complex, this method suits large volumes and is common with European suppliers. Benefits include:

stronger security through contracts and invoicing,

easy integration with accounting tools.

The downside is processing time, typically 2 to 5 business days, and interbank fees, especially for international transfers. Some Chinese or Turkish suppliers require SWIFT transfers, which can cost $10–$50 per transaction. For established relationships, this method remains reliable when deciding how to pay for dropshipping orders at scale.

Mobile Payments (Apple Pay, Google Pay)

Mobile payments like Apple Pay and Google Pay have grown fast in recent years. They offer:

a smooth user experience,

built-in security via Face ID or fingerprint authentication,

direct compatibility with Stripe and Shopify Payments, making setup easy.

You can also use mobile payments for quick tests or one-off product purchases through mobile apps. However, many suppliers still don’t accept them. Always confirm compatibility before choosing this option, especially when learning how to pay for dropshipping efficiently

How Do Payment Gateways and Payment Processors Work in Dropshipping?

When a customer places an order in your store, it’s not just a simple payment. A series of invisible technical interactions happen behind the scenes. To understand how to pay for dropshipping smoothly, from the customer to the supplier, you need to understand the role of payment gateways and payment processors.

What Is a Payment Gateway?

A payment gateway is a technical intermediary. It securely transmits a customer’s banking information to your payment system. Think of it as a digital bridge between your dropshipping store and the customer’s bank. The gateway does not hold funds; it only ensures secure data transfer.

How it works:

The customer submits payment details,

The gateway encrypts sensitive data,

The information is verified and sent to the payment processor.

This guarantees confidentiality and transaction security.

The most commonly used gateways in dropshipping are:

Stripe – known for its smooth interface and powerful API,

Shopify Payments – built directly into Shopify for easier management,

PayPal – globally recognized and easy to integrate.

What About the Payment Processor?

The payment processor is the service that actually executes the transaction. It communicates with the customer’s bank, checks fund availability, and transfers the money to your merchant account. This happens after the gateway step.

Examples of processors often connected to gateways include First Data, Worldpay, and Adyen. Some solutions, like Stripe and PayPal, act as both gateway and processor.

The key difference:

The gateway transmits information,

The processor validates and moves the funds.

How They Work Together

The full payment flow works as a smooth, automated chain:

The customer enters payment details on your store,

The gateway encrypts and transmits the data,

The processor validates the payment and completes the bank transaction,

Funds arrive in your merchant account or an intermediary balance (e.g., PayPal),

You then use these funds to pay your supplier.

This gateway–processor duo ensures a secure, fast, and dropshipping-friendly payment setup, critical when deciding how to pay for dropshipping orders at scale.

Create and test your Shopify store for only $1 per day during 90 days

Create and test your Shopify store for only $1 per day during 90 days

Create and test your Shopify store for only $1 per day during 90 days

Create and test your Shopify store for only $1 per day during 90 days

Create and test your Shopify store for only $1 per day during 90 days

Create and test your Shopify store for only $1 per day during 90 days

Best Payment Solutions for Dropshipping in 2026

Choosing the right payment solution directly affects order processing speed and supplier relationships. Here are the most reliable options today.

PayPal

PayPal is one of the most popular payment methods in eCommerce. It’s accepted by most dropshipping suppliers, especially on platforms like AliExpress, CJdropshipping, and Zendrop.

Pros

Available in 200+ countries,

Fast, near-instant payments,

Buyer and seller protection,

Easy integration with Shopify, WooCommerce, and PrestaShop.

Cons

Frequent fund holds in case of disputes or unusual activity,

High fees (around 2.9% + $0.30 in Europe, up to 4.4% for international sales),

Risk of account suspension if policies aren’t followed.

If you use PayPal to pay suppliers, choose a PayPal Business account. It offers higher limits, better dispute protection, and professional features like payment automation and multi-user access, useful when managing how to pay for dropshipping products consistently.

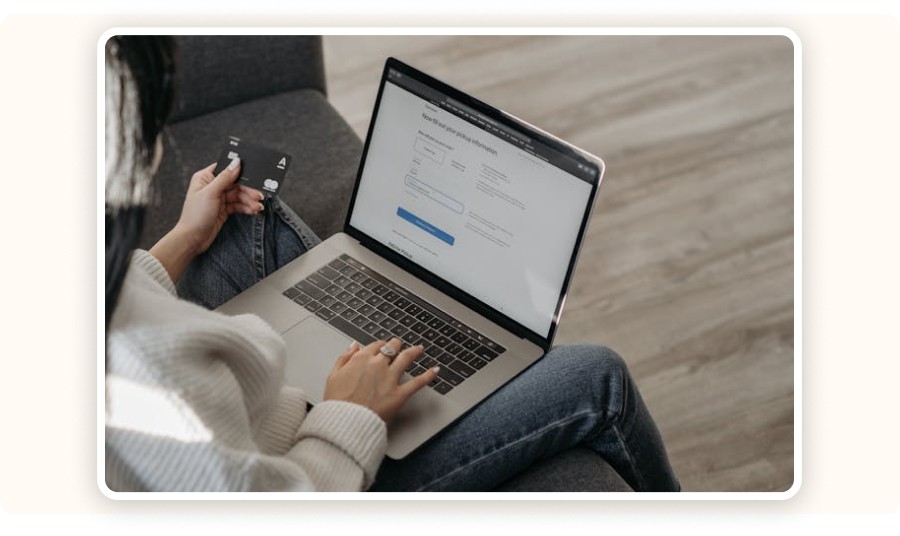

Stripe

Stripe is a modern, flexible payment solution ideal for dropshippers who want automation and scalability. It’s especially popular for recurring payments, subscriptions, and mobile payments via Apple Pay and Google Pay.

Pros

Compatible with Shopify, WooCommerce, ClickFunnels, and more,

Clean interface and powerful API,

Competitive fees: around 2.9% + $0.25 per transaction.

Cons

Not available in all countries (e.g., parts of Francophone Africa),

Account suspension risk if chargebacks are too high.

Stripe is a strong option when optimizing how to pay for the customer's product on dropshipping with speed and automation.

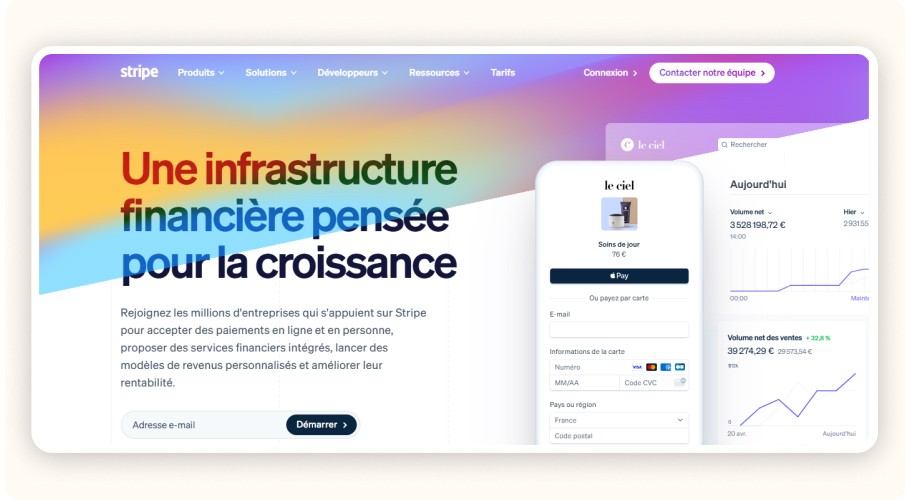

Shopify Payments

Shopify Payments is Shopify’s native payment solution. If your dropshipping store runs on Shopify, this is often the easiest option to set up. You’ll need a local bank account in a supported country.

Pros

No additional transaction fees,

Seamless integration with Shopify,

Fast and reliable payouts.

Cons

Available only in selected countries (e.g., France, Belgium, Switzerland, Canada),

Not compatible with certain products (e.g., CBD, tobacco, gambling).

Shopify Payments is ideal for simplifying operations while mastering how to pay for dropshipping orders without extra complexity

2Checkout (now Verifone)

Verifone (formerly 2Checkout) is a solid option for sellers operating internationally. It supports over 200 countries and 80 currencies, making it suitable for global dropshipping operations.

Pros

Ideal for dropshippers outside Europe,

Automatic multi-language and multi-currency support,

Accepts credit cards, PayPal, Apple Pay, and more.

Cons

Higher fees (around 3.5% to 5.5% depending on the plan),

Less flexible and intuitive than Stripe or PayPal.

Verifone is worth considering when figuring out how to pay for dropshipping orders across multiple regions without relying on a single local gateway.

Klarna

Klarna offers a popular Buy Now, Pay Later solution, especially in Europe. It allows customers to split payments into installments, which can significantly increase conversion rates and average order value.

Pros

Boosts sales with interest-free installment payments,

Compatible with Shopify and WooCommerce,

Reduces purchase hesitation for customers.

Cons

Mainly available in Europe,

Fees vary by country and transaction type.

Klarna is useful on the customer side when optimizing how to pay for the customers product on dropshipping and improving checkout performance.

Cryptocurrency Payments

Although still uncommon, some services allow suppliers to be paid with cryptocurrencies such as Bitcoin or Ethereum. Payments are processed through platforms like Coinbase Commerce or BitPay.

Pros

Very low or no transaction fees,

Secure and irreversible transactions,

Can suit modern or independent suppliers.

Cons

High price volatility,

Not accepted by most suppliers,

Requires technical knowledge.

Crypto payments can work for niche cases but are not ideal for beginners learning how to pay for dropshipping products at scale.

Payment Solution | Pros | Cons | Compatibility & Conditions |

|---|---|---|---|

PayPal | Accepted in 200+ countries, easy integration, fast payments, dispute protection | Frequent fund holds, high fees (up to 4.4%), suspension risk | Shopify, WooCommerce, PrestaShop – Business account recommended |

Stripe | Powerful API, Apple/Google Pay support, competitive fees (2.9% + $0.25) | Not available everywhere, chargeback risk | Shopify, WooCommerce, ClickFunnels |

Shopify Payments | No extra fees, native integration, fast payouts | Limited country availability, restricted products | Shopify only – local bank account required |

Verifone (2Checkout) | Global coverage (200 countries), multi-currency/language, cards & PayPal | Higher fees, less intuitive interface | All CMS via plugin/API – ideal for international |

Klarna | Installments boost AOV, Shopify/WooCommerce integration | Mostly Europe, variable fees | EU-based customers required |

Cryptocurrencies | Very low fees, secure, irreversible | Volatility, low adoption, technical setup | Via Coinbase Commerce, BitPay – modern suppliers only |

Reminder: What Is Dropshipping?

Dropshipping is an online selling model with no inventory. You run an online store and sell products, but you don’t handle stock or shipping. The supplier prepares and ships the order directly to the customer. Your role focuses on the storefront, marketing, and customer acquisition, while the supplier manages logistics.

However, nothing ships until the supplier is paid. That’s why choosing the right payment method is critical when deciding how to pay for dropshipping.

With fast, traceable, dispute-free payments, suppliers can ship quickly, allowing you to:

reduce delivery times,

improve customer experience,

protect your brand reputation.

Poorly managed payments, on the other hand, can quickly create serious operational issues

Best Payment Solutions for Dropshipping in 2026

Choosing the right payment solution directly affects order processing speed and supplier relationships. Here are the most reliable options today.

PayPal

PayPal is one of the most popular payment methods in eCommerce. It’s accepted by most dropshipping suppliers, especially on platforms like AliExpress, CJdropshipping, and Zendrop.

Pros

Available in 200+ countries,

Fast, near-instant payments,

Buyer and seller protection,

Easy integration with Shopify, WooCommerce, and PrestaShop.

Cons

Frequent fund holds in case of disputes or unusual activity,

High fees (around 2.9% + $0.30 in Europe, up to 4.4% for international sales),

Risk of account suspension if policies aren’t followed.

If you use PayPal to pay suppliers, choose a PayPal Business account. It offers higher limits, better dispute protection, and professional features like payment automation and multi-user access, useful when managing how to pay for dropshipping products consistently.

Stripe

Stripe is a modern, flexible payment solution ideal for dropshippers who want automation and scalability. It’s especially popular for recurring payments, subscriptions, and mobile payments via Apple Pay and Google Pay.

Pros

Compatible with Shopify, WooCommerce, ClickFunnels, and more,

Clean interface and powerful API,

Competitive fees: around 2.9% + $0.25 per transaction.

Cons

Not available in all countries (e.g., parts of Francophone Africa),

Account suspension risk if chargebacks are too high.

Stripe is a strong option when optimizing how to pay for the customer's product on dropshipping with speed and automation.

Shopify Payments

Shopify Payments is Shopify’s native payment solution. If your dropshipping store runs on Shopify, this is often the easiest option to set up. You’ll need a local bank account in a supported country.

Pros

No additional transaction fees,

Seamless integration with Shopify,

Fast and reliable payouts.

Cons

Available only in selected countries (e.g., France, Belgium, Switzerland, Canada),

Not compatible with certain products (e.g., CBD, tobacco, gambling).

Shopify Payments is ideal for simplifying operations while mastering how to pay for dropshipping orders without extra complexity

2Checkout (now Verifone)

Verifone (formerly 2Checkout) is a solid option for sellers operating internationally. It supports over 200 countries and 80 currencies, making it suitable for global dropshipping operations.

Pros

Ideal for dropshippers outside Europe,

Automatic multi-language and multi-currency support,

Accepts credit cards, PayPal, Apple Pay, and more.

Cons

Higher fees (around 3.5% to 5.5% depending on the plan),

Less flexible and intuitive than Stripe or PayPal.

Verifone is worth considering when figuring out how to pay for dropshipping orders across multiple regions without relying on a single local gateway.

Klarna

Klarna offers a popular Buy Now, Pay Later solution, especially in Europe. It allows customers to split payments into installments, which can significantly increase conversion rates and average order value.

Pros

Boosts sales with interest-free installment payments,

Compatible with Shopify and WooCommerce,

Reduces purchase hesitation for customers.

Cons

Mainly available in Europe,

Fees vary by country and transaction type.

Klarna is useful on the customer side when optimizing how to pay for the customers product on dropshipping and improving checkout performance.

Cryptocurrency Payments

Although still uncommon, some services allow suppliers to be paid with cryptocurrencies such as Bitcoin or Ethereum. Payments are processed through platforms like Coinbase Commerce or BitPay.

Pros

Very low or no transaction fees,

Secure and irreversible transactions,

Can suit modern or independent suppliers.

Cons

High price volatility,

Not accepted by most suppliers,

Requires technical knowledge.

Crypto payments can work for niche cases but are not ideal for beginners learning how to pay for dropshipping products at scale.

Payment Solution | Pros | Cons | Compatibility & Conditions |

|---|---|---|---|

PayPal | Accepted in 200+ countries, easy integration, fast payments, dispute protection | Frequent fund holds, high fees (up to 4.4%), suspension risk | Shopify, WooCommerce, PrestaShop – Business account recommended |

Stripe | Powerful API, Apple/Google Pay support, competitive fees (2.9% + $0.25) | Not available everywhere, chargeback risk | Shopify, WooCommerce, ClickFunnels |

Shopify Payments | No extra fees, native integration, fast payouts | Limited country availability, restricted products | Shopify only – local bank account required |

Verifone (2Checkout) | Global coverage (200 countries), multi-currency/language, cards & PayPal | Higher fees, less intuitive interface | All CMS via plugin/API – ideal for international |

Klarna | Installments boost AOV, Shopify/WooCommerce integration | Mostly Europe, variable fees | EU-based customers required |

Cryptocurrencies | Very low fees, secure, irreversible | Volatility, low adoption, technical setup | Via Coinbase Commerce, BitPay – modern suppliers only |

Reminder: What Is Dropshipping?

Dropshipping is an online selling model with no inventory. You run an online store and sell products, but you don’t handle stock or shipping. The supplier prepares and ships the order directly to the customer. Your role focuses on the storefront, marketing, and customer acquisition, while the supplier manages logistics.

However, nothing ships until the supplier is paid. That’s why choosing the right payment method is critical when deciding how to pay for dropshipping.

With fast, traceable, dispute-free payments, suppliers can ship quickly, allowing you to:

reduce delivery times,

improve customer experience,

protect your brand reputation.

Poorly managed payments, on the other hand, can quickly create serious operational issues

Best Payment Solutions for Dropshipping in 2026

Choosing the right payment solution directly affects order processing speed and supplier relationships. Here are the most reliable options today.

PayPal

PayPal is one of the most popular payment methods in eCommerce. It’s accepted by most dropshipping suppliers, especially on platforms like AliExpress, CJdropshipping, and Zendrop.

Pros

Available in 200+ countries,

Fast, near-instant payments,

Buyer and seller protection,

Easy integration with Shopify, WooCommerce, and PrestaShop.

Cons

Frequent fund holds in case of disputes or unusual activity,

High fees (around 2.9% + $0.30 in Europe, up to 4.4% for international sales),

Risk of account suspension if policies aren’t followed.

If you use PayPal to pay suppliers, choose a PayPal Business account. It offers higher limits, better dispute protection, and professional features like payment automation and multi-user access, useful when managing how to pay for dropshipping products consistently.

Stripe

Stripe is a modern, flexible payment solution ideal for dropshippers who want automation and scalability. It’s especially popular for recurring payments, subscriptions, and mobile payments via Apple Pay and Google Pay.

Pros

Compatible with Shopify, WooCommerce, ClickFunnels, and more,

Clean interface and powerful API,

Competitive fees: around 2.9% + $0.25 per transaction.

Cons

Not available in all countries (e.g., parts of Francophone Africa),

Account suspension risk if chargebacks are too high.

Stripe is a strong option when optimizing how to pay for the customer's product on dropshipping with speed and automation.

Shopify Payments

Shopify Payments is Shopify’s native payment solution. If your dropshipping store runs on Shopify, this is often the easiest option to set up. You’ll need a local bank account in a supported country.

Pros

No additional transaction fees,

Seamless integration with Shopify,

Fast and reliable payouts.

Cons

Available only in selected countries (e.g., France, Belgium, Switzerland, Canada),

Not compatible with certain products (e.g., CBD, tobacco, gambling).

Shopify Payments is ideal for simplifying operations while mastering how to pay for dropshipping orders without extra complexity

2Checkout (now Verifone)

Verifone (formerly 2Checkout) is a solid option for sellers operating internationally. It supports over 200 countries and 80 currencies, making it suitable for global dropshipping operations.

Pros

Ideal for dropshippers outside Europe,

Automatic multi-language and multi-currency support,

Accepts credit cards, PayPal, Apple Pay, and more.

Cons

Higher fees (around 3.5% to 5.5% depending on the plan),

Less flexible and intuitive than Stripe or PayPal.

Verifone is worth considering when figuring out how to pay for dropshipping orders across multiple regions without relying on a single local gateway.

Klarna

Klarna offers a popular Buy Now, Pay Later solution, especially in Europe. It allows customers to split payments into installments, which can significantly increase conversion rates and average order value.

Pros

Boosts sales with interest-free installment payments,

Compatible with Shopify and WooCommerce,

Reduces purchase hesitation for customers.

Cons

Mainly available in Europe,

Fees vary by country and transaction type.

Klarna is useful on the customer side when optimizing how to pay for the customers product on dropshipping and improving checkout performance.

Cryptocurrency Payments

Although still uncommon, some services allow suppliers to be paid with cryptocurrencies such as Bitcoin or Ethereum. Payments are processed through platforms like Coinbase Commerce or BitPay.

Pros

Very low or no transaction fees,

Secure and irreversible transactions,

Can suit modern or independent suppliers.

Cons

High price volatility,

Not accepted by most suppliers,

Requires technical knowledge.

Crypto payments can work for niche cases but are not ideal for beginners learning how to pay for dropshipping products at scale.

Payment Solution | Pros | Cons | Compatibility & Conditions |

|---|---|---|---|

PayPal | Accepted in 200+ countries, easy integration, fast payments, dispute protection | Frequent fund holds, high fees (up to 4.4%), suspension risk | Shopify, WooCommerce, PrestaShop – Business account recommended |

Stripe | Powerful API, Apple/Google Pay support, competitive fees (2.9% + $0.25) | Not available everywhere, chargeback risk | Shopify, WooCommerce, ClickFunnels |

Shopify Payments | No extra fees, native integration, fast payouts | Limited country availability, restricted products | Shopify only – local bank account required |

Verifone (2Checkout) | Global coverage (200 countries), multi-currency/language, cards & PayPal | Higher fees, less intuitive interface | All CMS via plugin/API – ideal for international |

Klarna | Installments boost AOV, Shopify/WooCommerce integration | Mostly Europe, variable fees | EU-based customers required |

Cryptocurrencies | Very low fees, secure, irreversible | Volatility, low adoption, technical setup | Via Coinbase Commerce, BitPay – modern suppliers only |

Reminder: What Is Dropshipping?

Dropshipping is an online selling model with no inventory. You run an online store and sell products, but you don’t handle stock or shipping. The supplier prepares and ships the order directly to the customer. Your role focuses on the storefront, marketing, and customer acquisition, while the supplier manages logistics.

However, nothing ships until the supplier is paid. That’s why choosing the right payment method is critical when deciding how to pay for dropshipping.

With fast, traceable, dispute-free payments, suppliers can ship quickly, allowing you to:

reduce delivery times,

improve customer experience,

protect your brand reputation.

Poorly managed payments, on the other hand, can quickly create serious operational issues

Best Payment Solutions for Dropshipping in 2026

Choosing the right payment solution directly affects order processing speed and supplier relationships. Here are the most reliable options today.

PayPal

PayPal is one of the most popular payment methods in eCommerce. It’s accepted by most dropshipping suppliers, especially on platforms like AliExpress, CJdropshipping, and Zendrop.

Pros

Available in 200+ countries,

Fast, near-instant payments,

Buyer and seller protection,

Easy integration with Shopify, WooCommerce, and PrestaShop.

Cons

Frequent fund holds in case of disputes or unusual activity,

High fees (around 2.9% + $0.30 in Europe, up to 4.4% for international sales),

Risk of account suspension if policies aren’t followed.

If you use PayPal to pay suppliers, choose a PayPal Business account. It offers higher limits, better dispute protection, and professional features like payment automation and multi-user access, useful when managing how to pay for dropshipping products consistently.

Stripe

Stripe is a modern, flexible payment solution ideal for dropshippers who want automation and scalability. It’s especially popular for recurring payments, subscriptions, and mobile payments via Apple Pay and Google Pay.

Pros

Compatible with Shopify, WooCommerce, ClickFunnels, and more,

Clean interface and powerful API,

Competitive fees: around 2.9% + $0.25 per transaction.

Cons

Not available in all countries (e.g., parts of Francophone Africa),

Account suspension risk if chargebacks are too high.

Stripe is a strong option when optimizing how to pay for the customer's product on dropshipping with speed and automation.

Shopify Payments

Shopify Payments is Shopify’s native payment solution. If your dropshipping store runs on Shopify, this is often the easiest option to set up. You’ll need a local bank account in a supported country.

Pros

No additional transaction fees,

Seamless integration with Shopify,

Fast and reliable payouts.

Cons

Available only in selected countries (e.g., France, Belgium, Switzerland, Canada),

Not compatible with certain products (e.g., CBD, tobacco, gambling).

Shopify Payments is ideal for simplifying operations while mastering how to pay for dropshipping orders without extra complexity

2Checkout (now Verifone)

Verifone (formerly 2Checkout) is a solid option for sellers operating internationally. It supports over 200 countries and 80 currencies, making it suitable for global dropshipping operations.

Pros

Ideal for dropshippers outside Europe,

Automatic multi-language and multi-currency support,

Accepts credit cards, PayPal, Apple Pay, and more.

Cons

Higher fees (around 3.5% to 5.5% depending on the plan),

Less flexible and intuitive than Stripe or PayPal.

Verifone is worth considering when figuring out how to pay for dropshipping orders across multiple regions without relying on a single local gateway.

Klarna

Klarna offers a popular Buy Now, Pay Later solution, especially in Europe. It allows customers to split payments into installments, which can significantly increase conversion rates and average order value.

Pros

Boosts sales with interest-free installment payments,

Compatible with Shopify and WooCommerce,

Reduces purchase hesitation for customers.

Cons

Mainly available in Europe,

Fees vary by country and transaction type.

Klarna is useful on the customer side when optimizing how to pay for the customers product on dropshipping and improving checkout performance.

Cryptocurrency Payments

Although still uncommon, some services allow suppliers to be paid with cryptocurrencies such as Bitcoin or Ethereum. Payments are processed through platforms like Coinbase Commerce or BitPay.

Pros

Very low or no transaction fees,

Secure and irreversible transactions,

Can suit modern or independent suppliers.

Cons

High price volatility,

Not accepted by most suppliers,

Requires technical knowledge.

Crypto payments can work for niche cases but are not ideal for beginners learning how to pay for dropshipping products at scale.

Payment Solution | Pros | Cons | Compatibility & Conditions |

|---|---|---|---|

PayPal | Accepted in 200+ countries, easy integration, fast payments, dispute protection | Frequent fund holds, high fees (up to 4.4%), suspension risk | Shopify, WooCommerce, PrestaShop – Business account recommended |

Stripe | Powerful API, Apple/Google Pay support, competitive fees (2.9% + $0.25) | Not available everywhere, chargeback risk | Shopify, WooCommerce, ClickFunnels |

Shopify Payments | No extra fees, native integration, fast payouts | Limited country availability, restricted products | Shopify only – local bank account required |

Verifone (2Checkout) | Global coverage (200 countries), multi-currency/language, cards & PayPal | Higher fees, less intuitive interface | All CMS via plugin/API – ideal for international |

Klarna | Installments boost AOV, Shopify/WooCommerce integration | Mostly Europe, variable fees | EU-based customers required |

Cryptocurrencies | Very low fees, secure, irreversible | Volatility, low adoption, technical setup | Via Coinbase Commerce, BitPay – modern suppliers only |

Reminder: What Is Dropshipping?

Dropshipping is an online selling model with no inventory. You run an online store and sell products, but you don’t handle stock or shipping. The supplier prepares and ships the order directly to the customer. Your role focuses on the storefront, marketing, and customer acquisition, while the supplier manages logistics.

However, nothing ships until the supplier is paid. That’s why choosing the right payment method is critical when deciding how to pay for dropshipping.

With fast, traceable, dispute-free payments, suppliers can ship quickly, allowing you to:

reduce delivery times,

improve customer experience,

protect your brand reputation.

Poorly managed payments, on the other hand, can quickly create serious operational issues

Best Payment Solutions for Dropshipping in 2026

Choosing the right payment solution directly affects order processing speed and supplier relationships. Here are the most reliable options today.

PayPal

PayPal is one of the most popular payment methods in eCommerce. It’s accepted by most dropshipping suppliers, especially on platforms like AliExpress, CJdropshipping, and Zendrop.

Pros

Available in 200+ countries,

Fast, near-instant payments,

Buyer and seller protection,

Easy integration with Shopify, WooCommerce, and PrestaShop.

Cons

Frequent fund holds in case of disputes or unusual activity,

High fees (around 2.9% + $0.30 in Europe, up to 4.4% for international sales),

Risk of account suspension if policies aren’t followed.

If you use PayPal to pay suppliers, choose a PayPal Business account. It offers higher limits, better dispute protection, and professional features like payment automation and multi-user access, useful when managing how to pay for dropshipping products consistently.

Stripe

Stripe is a modern, flexible payment solution ideal for dropshippers who want automation and scalability. It’s especially popular for recurring payments, subscriptions, and mobile payments via Apple Pay and Google Pay.

Pros

Compatible with Shopify, WooCommerce, ClickFunnels, and more,

Clean interface and powerful API,

Competitive fees: around 2.9% + $0.25 per transaction.

Cons

Not available in all countries (e.g., parts of Francophone Africa),

Account suspension risk if chargebacks are too high.

Stripe is a strong option when optimizing how to pay for the customer's product on dropshipping with speed and automation.

Shopify Payments

Shopify Payments is Shopify’s native payment solution. If your dropshipping store runs on Shopify, this is often the easiest option to set up. You’ll need a local bank account in a supported country.

Pros

No additional transaction fees,

Seamless integration with Shopify,

Fast and reliable payouts.

Cons

Available only in selected countries (e.g., France, Belgium, Switzerland, Canada),

Not compatible with certain products (e.g., CBD, tobacco, gambling).

Shopify Payments is ideal for simplifying operations while mastering how to pay for dropshipping orders without extra complexity

2Checkout (now Verifone)

Verifone (formerly 2Checkout) is a solid option for sellers operating internationally. It supports over 200 countries and 80 currencies, making it suitable for global dropshipping operations.

Pros

Ideal for dropshippers outside Europe,

Automatic multi-language and multi-currency support,

Accepts credit cards, PayPal, Apple Pay, and more.

Cons

Higher fees (around 3.5% to 5.5% depending on the plan),

Less flexible and intuitive than Stripe or PayPal.

Verifone is worth considering when figuring out how to pay for dropshipping orders across multiple regions without relying on a single local gateway.

Klarna

Klarna offers a popular Buy Now, Pay Later solution, especially in Europe. It allows customers to split payments into installments, which can significantly increase conversion rates and average order value.

Pros

Boosts sales with interest-free installment payments,

Compatible with Shopify and WooCommerce,

Reduces purchase hesitation for customers.

Cons

Mainly available in Europe,

Fees vary by country and transaction type.

Klarna is useful on the customer side when optimizing how to pay for the customers product on dropshipping and improving checkout performance.

Cryptocurrency Payments

Although still uncommon, some services allow suppliers to be paid with cryptocurrencies such as Bitcoin or Ethereum. Payments are processed through platforms like Coinbase Commerce or BitPay.

Pros

Very low or no transaction fees,

Secure and irreversible transactions,

Can suit modern or independent suppliers.

Cons

High price volatility,

Not accepted by most suppliers,

Requires technical knowledge.

Crypto payments can work for niche cases but are not ideal for beginners learning how to pay for dropshipping products at scale.

Payment Solution | Pros | Cons | Compatibility & Conditions |

|---|---|---|---|

PayPal | Accepted in 200+ countries, easy integration, fast payments, dispute protection | Frequent fund holds, high fees (up to 4.4%), suspension risk | Shopify, WooCommerce, PrestaShop – Business account recommended |

Stripe | Powerful API, Apple/Google Pay support, competitive fees (2.9% + $0.25) | Not available everywhere, chargeback risk | Shopify, WooCommerce, ClickFunnels |

Shopify Payments | No extra fees, native integration, fast payouts | Limited country availability, restricted products | Shopify only – local bank account required |